Picture this. You’re sitting in a quarterly business review. Procurement has just presented a beautiful deck, dashboards, pie charts, year-on-year trends. There’s polite applause. Then the room moves on… and nothing changes.

No sourcing initiatives. No supplier renegotiations. No new strategies.

Just another report, filed neatly into a folder nobody will open again.

Sound familiar?

It’s a trap too many procurement teams fall into: investing in spend analytics without demanding spend impact. When your process becomes all about inputs, and no enterprise outcomes, you’re not doing strategy. You’re doing glorified admin.

This article walks you through 13 clear signs that your spend analysis might be missing the mark, and how you can fix it before your influence fades for good.

If your spend analytics process is all inputs and no impact, you’re not doing strategy—you’re doing glorified admin. Here’s how to spot it (and fix it).

1. You’re reporting, not recommending

Reporting vs Recommending: Why Your Spend Data Analysis Must Drive Action

Spend data analysis isn’t valuable because it produces tidy reports, it’s valuable because it drives better decisions. Yet too often, procurement teams stop at presenting dashboards or spreadsheets that simply describe “what” happened, without offering insights into “so what” or “now what.”

If your spend analysis outputs end with data, not direction, you’re not enabling strategy; you’re maintaining expensive admin. CPOs and business leaders don’t just want numbers; they want clear, actionable recommendations they can trust to move the business forward.

Effective procurement spend analysis transforms raw data into informed strategies: identifying consolidation opportunities, shaping supplier conversations, and prioritising high-impact initiatives. If your team isn’t taking that next step, you’re missing the true value of your spend data analysis investment, and leaving influence on the table.

2. No one outside procurement looks at your dashboards

Procurement Data Analysis That Stays Inside Procurement Is Failing

Procurement data analysis should fuel better decisions across the organisation, not just within the procurement function. If Finance, IT, or business leaders aren’t actively engaging with your reports, it’s a clear sign your procurement data analytics aren’t aligned with broader business priorities.

Effective spend analysis speaks the language of its audience: risk mitigation for Finance, innovation opportunities for IT, strategic sourcing levers for operations. If your dashboards aren’t sparking conversations beyond procurement, you’re producing static reports, not enabling enterprise value.

A dashboard that only procurement reads isn’t an insight tool, it’s an archive.

The real goal isn’t just building dashboards; it’s embedding procurement insights into cross-functional decision-making, so spend data becomes a catalyst for action, not a quiet record of past transactions.

3. Your team spends more time formatting slides than influencing decisions

Why Procurement Data Analysts Must Focus on Influence, Not Presentations

If your procurement data analyst team spends more time refining slides than influencing sourcing strategies or stakeholder decisions, you’re not maximising their value. Beautiful decks might impress for a moment, but they don’t move the dial if they aren’t tied to action.

The role of analytics in procurement is to inform decisions, prioritise opportunities, and shape outcomes, not just to present findings. Time spent polishing slides should be a fraction compared to time spent collaborating with business units, surfacing risks, and steering sourcing conversations.

PowerPoint isn’t the goal, business impact is.

When analysts are empowered to influence, not just report, procurement data analysis becomes a critical lever for competitive advantage, not an internal reporting exercise.

4. You’re tracking what’s easy, not what matters

Spend Analysis Best Practices: Tracking Outcomes Over Activities

If your primary metrics focus on “% of spend classified” or “records processed,” you’re measuring hygiene, not strategy. While clean data is essential, it’s only the starting point. Spend analysis best practices push beyond surface-level activity to focus on what truly matters: how much spend is being influenced, how many sourcing opportunities are uncovered, and how business outcomes are improving as a result.

Not all KPIs are created equal, and some can quietly steer procurement teams off course.

Tracking easy wins may look good on a dashboard, but it won’t earn a seat at the strategic table. Real procurement impact comes from linking spend visibility to enterprise priorities like savings, innovation, supplier diversity, or ESG performance, not just from ticking operational boxes.

5. Your insights never result in supplier conversations

How Supplier Spend Segmentation Should Lead to Supplier Action

If spend analysis doesn’t reach the supplier table, it isn’t strategic, it’s cosmetic.

Great supplier spend segmentation and spend categorisation techniques should directly enable supplier conversations that drive real change: renegotiating terms, consolidating partners, or introducing innovation opportunities.

When procurement teams build spend reports without linking them to supplier engagement, they’re missing the true purpose of analysis, to influence the supply base and create value. Spend classification isn’t just about internal visibility; it’s about setting the stage for external action.

If your spend insights haven’t sparked a renegotiation, a supplier rationalisation project, or a discussion about contract terms, it’s time to rethink whether you’re generating business intelligence, or just decorating dashboards.

6. You’re still measuring success in rows, not results

Measuring Spend Analysis Success: From Data Volume to Business Impact

Cleansing 1,000 rows of data might feel like progress, but unless it leads to a sourcing opportunity, it’s just busywork.

A strong spend analysis process isn’t about how much data you process; it’s about how much value you extract. Procurement teams that focus on volume, rows reviewed, suppliers classified, dashboards built, risk losing sight of the bigger picture: driving better supplier strategies, unlocking savings, and influencing business outcomes.

Volume without value is just administrative overhead. Results are what matter. If your spend analysis isn’t leading to cost reductions, risk mitigations, or supplier innovations, it’s time to refocus the team’s energy from maintenance to impact.

7. Nobody owns the taxonomy

Procurement Spend Data Analysis Needs Clear Taxonomy Ownership

If every business unit defines “professional services” differently, your procurement spend data analysis is less a strategic tool and more a tower of Babel.

Without clear ownership and governance, taxonomy becomes fragmented, inconsistent, and ultimately unusable for decision-making. Inconsistent category definitions erode the credibility of spend insights, making it impossible to benchmark, consolidate, or even have a coherent supplier conversation.

In leading organisations across Australia and New Zealand, procurement spend data analysis is underpinned by strong taxonomy governance, with clear accountability for maintenance, periodic review cycles, and cross-functional agreement on key definitions.

A unified taxonomy isn’t bureaucracy. It’s the foundation that allows procurement to surface insights that the business can trust, act on, and align around.

8. Your ABC analysis hasn’t changed in two years

Why Your ABC Analysis in Procurement Must Evolve With Your Business

Markets shift. Business priorities evolve. Supplier landscapes transform.

If your ABC analysis in procurement still mirrors your FY24 priorities, you’re not leading change, you’re lagging behind it. Category prioritisation isn’t a set-and-forget exercise; it should be a living, breathing reflection of strategic risk, opportunity, and business needs.

Static ABC models quickly lose relevance in a dynamic environment, masking emerging risks or hiding new sources of value. Best practice organisations reassess category importance regularly, using both internal shifts and external market signals to drive reclassification.

If your “A” categories haven’t changed, ask yourself: is that because the business hasn’t evolved, or because procurement hasn’t been keeping up?

9. Your dashboards say “what,” not “so what”

Procurement Data Analytics: Moving Beyond Spend Reporting to Strategic Insights

Showing who you spent with last quarter isn’t enough. Decision-makers don’t just need what happened, they need what it means and what comes next.

Too often, procurement data analytics stops at describing spend patterns without layering in the context of risk, opportunity, or strategic levers. Without that next layer, your insights won’t gain traction across the business, and your indirect procurement strategies will stall at the starting line.

The best spend dashboards move beyond descriptive analytics. They prioritise predictive and prescriptive insights: where consolidation opportunities exist, where supplier risk is rising, and what sourcing actions should be triggered. Data without a clear narrative isn’t analysis, it’s just administration.

10. You’re still manually cleaning data every cycle

Why Manual Spend Analysis Processes Are Holding Procurement Back

Manual data cleansing might feel satisfying in the moment, but it’s a sign your spend analysis process is stuck in first gear.

If every reporting cycle requires Excel gymnastics to deduplicate suppliers, reclassify categories, or patch gaps, you’re pouring time and talent into maintenance rather than value creation. In a landscape where speed, accuracy, and agility matter, manual processes simply can’t keep up.

Leading data analytics companies in Melbourne, and procurement teams across Australia and New Zealand, are investing in automation: robotic process automation (RPA), machine learning-based classification, and API-driven data refreshes. Not because it’s trendy, but because it’s the only way to scale insights at the speed business demands.

Spend analysis should enable strategy, not consume resources. Automation isn’t a luxury, it’s now the baseline for competitiveness.

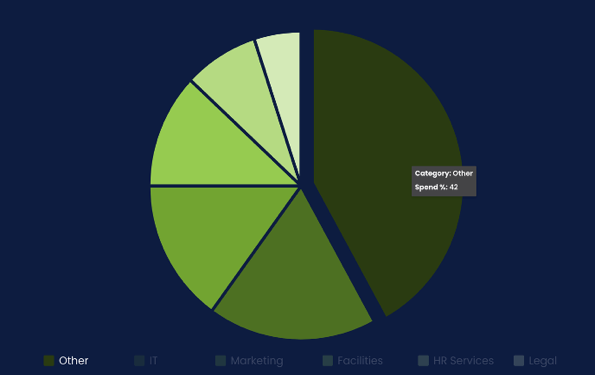

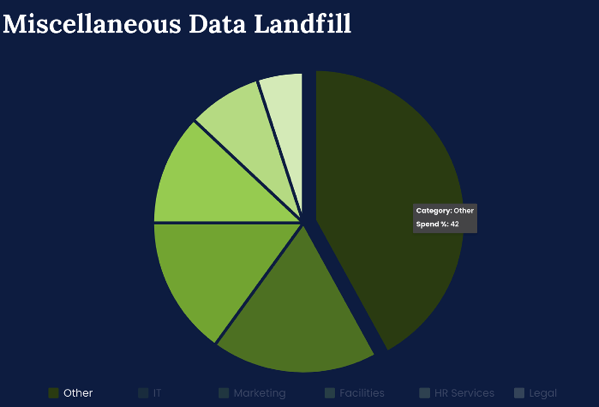

11. Your “Other” category is the biggest one

Spend Data Classification Fail: When ‘Miscellaneous’ Dominates Your Categories

When “Other” tops your list of spend categories, it’s not just a data issue, it’s a credibility issue.

If miscellaneous spend outweighs core categories like marketing, facilities, or professional services, your organisation doesn’t have a spend profile, it has a data landfill. And no amount of reporting will turn clutter into clarity.

Effective spend data classification is the backbone of actionable procurement strategy. Without it, supplier spend segmentation efforts collapse, category strategies misfire, and stakeholder trust erodes. Leaders know: if you can’t categorise your spend with precision, you can’t control it, influence it, or optimise it.

Fix the classification first. Otherwise, you’re building spend analysis on a foundation of sand.

12. Stakeholders see procurement as data librarians, not advisors

Elevating the Procurement Data Analyst: From Data Keeper to Strategic Advisor

If business units come to procurement for reports, but not for guidance, you haven’t built a strategy function; you’ve built a service desk.

A procurement data analyst shouldn’t just retrieve information on request. They should proactively surface risks, highlight opportunities, and help shape smarter business decisions. True influence in procurement comes not from producing data on demand, but from embedding insights into the organisation’s strategic planning.

When procurement is seen as a trusted advisor, not just a record keeper, it shifts from an operational support role to a genuine business partner. And that shift starts with spend analysis that connects insights to outcomes, not just activities to reports.

13. You haven’t booked a single sourcing initiative off your last analysis

Turning Procurement Spend Analysis Into Real Sourcing Initiatives

If your last round of reporting didn’t trigger a sourcing initiative, a renegotiation, or a supplier change, it’s time for a reality check.

Spend analysis without action isn’t strategy, it’s administration. Worse, it’s expensive administration that consumes time, budget, and credibility without delivering return. A strong spend analysis process should always create a pipeline of sourcing opportunities, supplier reviews, or at the very least, informed stakeholder conversations.

If procurement spend analysis isn’t producing a clear next step, it’s not working. Every insight should either save money, reduce risk, drive innovation, or strengthen supplier partnerships. Anything less is just documentation, and the business deserves more.

The next time you’re about to present spend analytics to your leadership team, ask yourself:

Are we giving them a spreadsheet… or a strategy?

Because procurement’s role is bigger than reporting past spend. It’s about influencing future decisions, shaping supplier relationships, and steering the organisation toward stronger, smarter outcomes.

If your current spend analysis isn’t opening new doors, with Finance, with business leaders, with suppliers, it’s time to rethink not just what you’re measuring, but how you’re using it.

The organisations that win will be the ones who turn data into action, insight into influence, and reports into results.

Don’t let your hard work end up as another forgotten deck in another forgotten folder.

- Curious about how your spend analytics could deliver more impact, not just more admin?

- Want to explore new ways to shift from dashboards to decision-making?

- Ready to turn supplier data into sourcing success?

Book a meeting with Purchasing Index today.

We’ll help you unpack your current approach, your thoughts, your needs, your dreams, and build a roadmap to transform your procurement data into a genuine strategic asset.

Book your strategy session here.

(Or connect with our team for a deeper conversation.)

Get Procurement Insights That Matter

Join 10,000+ procurement professionals getting monthly expert cost-optimisation strategies and exclusive resources. Unsubscribe anytime.

Join