If dashboards are the eyes of procurement, then KPIs are the lenses that bring everything into focus.

Without the right performance indicators, even the most beautifully designed dashboard becomes misleading, or worse, completely useless.

You’ve defined your strategic questions. You understand what decisions your dashboard needs to support. Now comes the hard part: choosing which KPIs actually deserve space on your screen.

Walk into most procurement departments and you’ll find teams drowning in metrics. Cost per transaction, supplier diversity ratios, cycle time averages, contract utilisation rates, savings percentages, risk scores – the list goes on. Each metric tells a story, but together they often create nothing but noise.

Strategic procurement requires KPIs that don’t just describe the business but help change it. That means focusing on what drives decisions, performance, and impact, not just what’s easy to measure.

What Makes a KPI “Strategic” in Procurement?

A strategic KPI helps an organisation answer three critical questions:

- Are we moving in the right direction?

- Are we making progress toward our procurement goals?

- Where do we need to take action?

Strategic KPIs are decision-enabling. They link procurement activity to organisational outcomes, such as cost savings, risk reduction, policy compliance, or supplier value. If a KPI doesn’t influence a decision or change a behaviour, it’s not strategic, it’s just sophisticated noise.

For example, tracking the total number of purchase orders is descriptive. But tracking PO cycle time (from requisition to approval) highlights efficiency bottlenecks and prompts process improvement. That’s the difference between measurement and management.

The Hierarchy of Procurement Value: Understanding What Actually Matters

Not all KPIs are created equal. The most effective procurement dashboards organise metrics around a clear value hierarchy, starting with outcomes and working down to activities.

Outcome Metrics (Top Tier): These measure the ultimate impact of procurement on the organisation. Total cost savings achieved, spend under management, supplier performance to SLA, compliance rates. These are the metrics that matter to executives and directly tie to business results.

Process Metrics (Middle Tier): These tracks how well procurement processes are functioning. Contract cycle times, sourcing event completion rates, supplier onboarding duration. Important for operational efficiency but meaningless if they don’t connect to better outcomes.

Activity Metrics (Bottom Tier): These count what people are doing. Number of RFPs issued, contracts processed, supplier meetings held. Useful for resource planning but dangerous if mistaken for value creation.

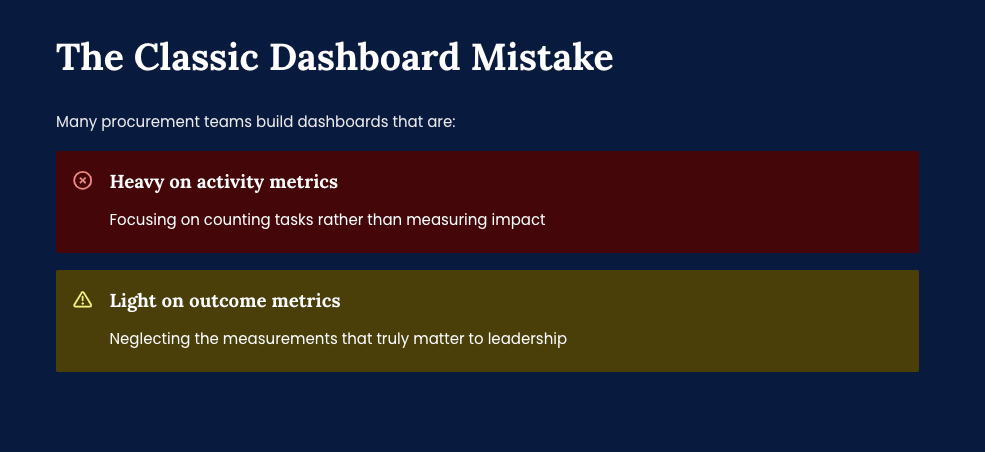

The classic mistake is building dashboards heavy on activity metrics while starving outcome metrics of attention. Your CFO doesn’t care how many purchase orders were processed last month – they care whether procurement saved money and mitigated risk.

Strategic KPIs by Procurement Function

1. Strategic Sourcing KPIs

Strategic sourcing is all about optimising cost, value, and supplier alignment. KPIs in this area should reflect savings achieved and sourcing process efficiency.

- Cost Savings (Realised & Forecasted): Track both negotiated savings and savings actually captured. But here’s the key: measure both hard savings (reduced unit costs) and cost avoidance (preventing increases). Break it down by sourcing project or category to identify where your sourcing team delivers the most impact.

- Spend Under Management (SUM): The percentage of total spend that goes through formal sourcing processes or approved channels. This isn’t just about control – it’s about leverage. Unmanaged spend means missed savings opportunities, compliance gaps, and reduced negotiating power.

- Sourcing Cycle Time: Measure how long it takes to complete an RFP or tender, from initiation to award. This process metric directly impacts your ability to capture market opportunities and respond to business needs.

- Sourcing Project ROI: Compare the effort and resources spent on sourcing activities to the value they generate. This helps prioritise where to focus your sourcing team’s limited time.

These KPIs help answer: Are we sourcing efficiently? Are we delivering measurable value?

2. Contract Management KPIs

Contracts are where negotiated value becomes real value, but only if they’re used and executed properly. These KPIs assess how well contracts deliver on their promise.

- Contract Utilisation Rate: The percentage of spend against available contracts. Low utilisation often signals poor adoption, lack of awareness, or contracts that don’t meet user needs.

- Contract Compliance Rate: Measures how much purchasing adheres to the terms of existing contracts (pricing, suppliers, volume commitments). This directly impacts both savings realisation and risk management.

- Upcoming Renewals or Expiries: Track the number of contracts expiring in the next 90/180 days to avoid lapses or rushed renegotiations that undermine your negotiating position.

- Cycle Time to Execute Contracts: Time taken from drafting to final signature, important for efficiency and speed-to-market, especially in fast-moving categories.

These indicators highlight opportunities to optimise contract value and prevent leakage.

3. Supplier Relationship Management (SRM) KPIs

Effective SRM ensures supplier performance, reduces risk, and strengthens partnerships. The best SRM KPIs combine performance measurement with risk intelligence.

- On-Time Delivery Rate: The percentage of orders delivered on or before the agreed date. Critical for operational continuity and customer satisfaction.

- Supplier Performance Index: Combines key indicators like defect rates, SLA compliance, and quality metrics into a weighted score. This prevents the common trap of managing suppliers reactively after problems occur.

- Supplier Lead Time: Average time from order to delivery. Essential for demand planning and inventory optimisation.

- Single-Source Dependency Count: Number of suppliers that are the only source for a given item or category, flagging potential business continuity risk.

- Supplier Risk Rating: A composite measure of financial, operational, ESG, or geopolitical risk that helps prioritise relationship management efforts.

These KPIs inform procurement teams on who to trust, where to mitigate risk, and where to invest relationship capital.

Compliance and Policy-Focused KPIs for Government and NFPs

In government and non-profit procurement, performance isn’t just about cost, it’s about stewardship, accountability, and mission alignment.

Important metrics include:

- Maverick Spend (% of Total): Purchases made outside of approved contracts or channels. Critical for demonstrating fiscal responsibility and policy compliance.

- Spend with Diverse or Local Suppliers: Tracks engagement with minority-owned, women-owned, or small/local businesses to meet policy mandates and community investment goals.

- Procurement Transparency Metrics: Number of open tenders, award disclosures, or adherence to public procurement timelines. Essential for maintaining public trust.

- Ethical or Sustainable Sourcing Score: Reflects compliance with environmental, labour, or fair-trade standards that align with organisational values.

These KPIs help demonstrate procurement’s value as a policy instrument, not just a business function.

Balancing Operational vs. Strategic Metrics

A well-balanced dashboard includes both operational and strategic metrics, but in the right proportions:

Operational metrics help monitor day-to-day efficiency (PO approval time, invoice accuracy, supplier response rates). These improve processes and help teams solve problems faster.

Strategic metrics speak to bigger-picture goals (cost avoidance, supplier innovation, market share capture). These inform leadership, guide investment, and track long-term outcomes.

Don’t confuse activity for impact. A dashboard full of operational metrics might look busy but still miss the strategic point.

The magic ratio? Roughly 70% strategic outcomes, 30% operational processes for executive dashboards. Flip that ratio for operational team dashboards.

The Goldilocks Principle: How Many KPIs is Just Right?

Here’s where most dashboards go wrong: they assume more metrics equal better insights. The opposite is true.

Cognitive psychology tells us humans can effectively process about 5-9 pieces of information simultaneously.

Dashboard design should respect this limit, not ignore it.

For executive dashboards, 3-5 high-level KPIs are optimal, focusing on outcomes that directly impact business performance.

For operational dashboards used by procurement teams, 7-12 KPIs work well, mixing outcomes with key process metrics.

For deep-dive analytical views, you can include more detail, but these should be separate screens accessed when needed, not cluttering the primary view.

Common Pitfalls: Avoiding Vanity Metrics and Data Traps

Vanity metrics are numbers that look good on paper but don’t change decisions. Think: “number of suppliers onboarded” or “total RFPs issued.” Without context or outcome tracking, these don’t tell you whether you’re succeeding.

Also beware of:

- Incomplete or Poor Quality Data: A KPI based on bad or missing data is worse than none at all. Before launching any dashboard, ensure consistent spend classification, clean supplier master data, and reliable contract linkages.

- Lack of Context: Comparing suppliers or categories without adjusting for volume, risk, or strategic importance leads to misleading insights. Always provide historical trends, targets, and benchmarks where possible.

- Metric Overload: Too many KPIs dilute focus and overwhelm users. Choose a small set that matters most and measure them exceptionally well.

- Activity Masquerading as Outcomes: Don’t mistake being busy for being effective. Ensure each KPI connects to business impact, not just procurement activity.

Make sure each KPI has a clear purpose, a designated owner, and most importantly, that it drives action when performance deviates from target.

Making Procurement KPIs Actionable: From Measurement to Management

The best procurement KPIs don’t just measure performance – they guide action.

When you’re selecting metrics for your dashboard, ask yourself: if this number moves in the wrong direction, do I know what to do about it?

Each KPI should come with an implicit action plan. When spend under management starts declining, the response isn’t to panic – it’s to systematically identify which categories are experiencing the highest leakage and launch targeted category management initiatives.

When savings targets are missed, effective procurement teams don’t just report the shortfall – they analyse pipeline health and accelerate sourcing events in the categories with the highest impact potential. Rising contract non-compliance signals a need for user education and stronger procurement controls in the business units showing the most maverick behaviour.

Declining supplier performance triggers supplier development programmes or the initiation of alternative sourcing activities before operational disruption occurs.

This is the fundamental test of a good KPI: not whether it accurately measures reality, but whether measuring that reality leads to better decisions and improved outcomes.

Your metrics aren’t neutral observers of procurement performance – they’re active shapers of behaviour and decision-making. The difference between procurement teams that struggle and those that excel often comes down to this: knowing which numbers actually matter, and relentlessly focusing on making those numbers better.

Are your KPIs strategic, actionable, and aligned with your goals? Or are they just filling space on a dashboard?

At PI Data Analytics, we help procurement teams identify the metrics that matter most and design dashboards around actionable insights.

Book a consultation.

Let’s build your measurement strategy, not just your charts.

Get Procurement Insights That Matter

Join 10,000+ procurement professionals getting monthly expert cost-optimisation strategies and exclusive resources. Unsubscribe anytime.

Join